- cross-posted to:

- worldnews@lemmy.ml

- cross-posted to:

- worldnews@lemmy.ml

Global stock markets fell sharply and gold hit a record high after two US regional banks said they had been left exposed to millions of dollars of bad loans and alleged fraud.

Signs of credit stress rattled markets across Europe and Asia. In London the FTSE 100 fell 1.5%, Germany’s Dax fell 2%, the Ibex in Spain was off 0.8% and France’s Cac 40 dropped 1.5%, before recovering some ground.

Concerns over credit stress in the network of loans to businesses across the world’s largest economy fuelled heavy losses on Wall Street on Thursday, followed by Asian markets, with Japan’s Nikkei 225 falling 1.6% and the Hang Seng in Hong Kong dropping 2%. US markets are expected to open down later on Friday.

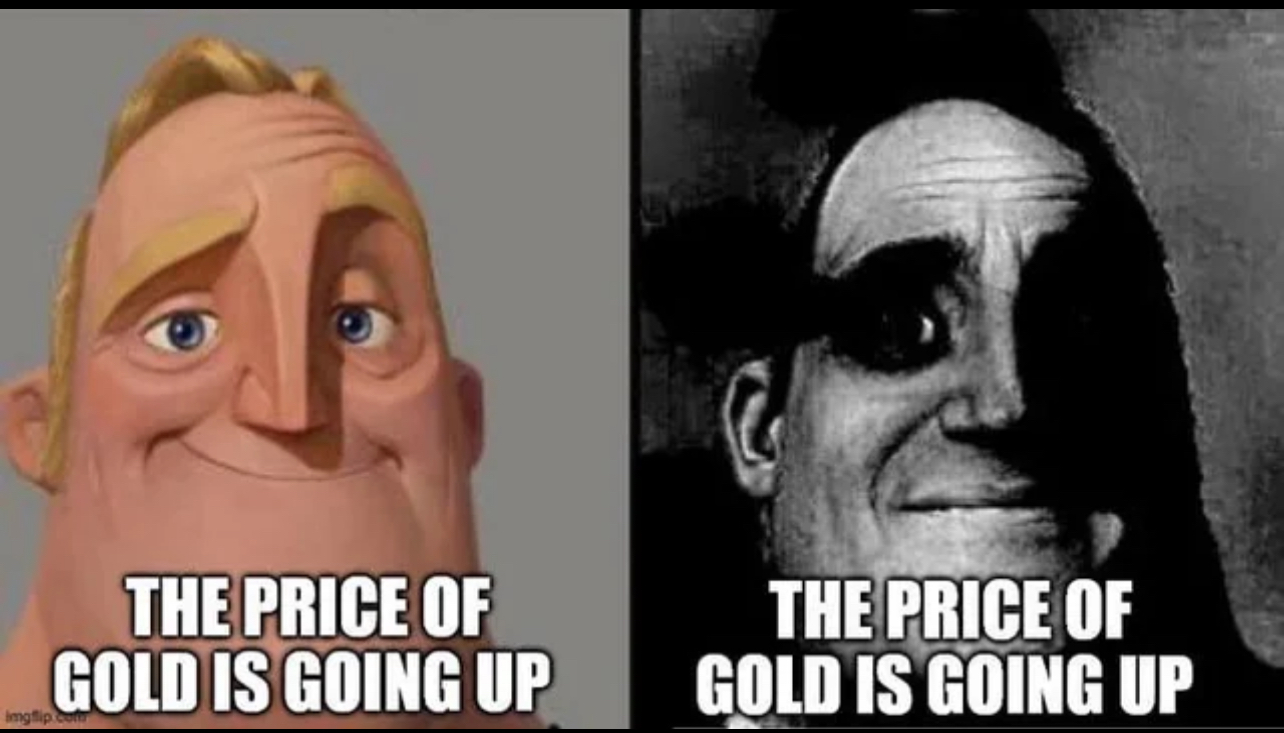

Brace yourself, a bunch of gold investments ads will be playing on Fox News and facebook soon…

Goldbugs were right after all. To be fair it’s always been a much, much better investment than shit like crypto or stocks. At least gold is real and has real uses in the real world.

…until Bezos or Musk or one of their nepo-spawn drag an asteroid into orbit, then all metals will be priced according to their stranglehold on the resulting glut in supply, like diamonds.

Till we find a way to synthesize gold at a large enough scale for manufacturing demands to be fully met it’s never going to lose value.